The Ibraco-Peremba case The taxpayer in this case a property developer purchased land in 1992 for long term investment purposes and. From the perspective of revenue authorities it is equally important to counter tax avoidance.

Difference Between Wire Transfer Swift And Ach Automated Clearing House First Time Home Buyers Buying Your First Home Finance Loans

Thus in most tax jurisdictions anti-avoidance provisions are included in the tax laws to defeat or pre-empt anticipated avoidance schemes mischief or to plug loopholes that.

. We are constantly being. 2000 estimated the size of hidden income and tax evasion for Malaysia. The formula for capital gains in the double tax avoidance agreement with Malaysia which has been ratified is usually contained in Article 13 and it can be concluded in the first paragraph in.

Using a false identity for tax purposes. Failure to file an income tax return. Malaysia Evidence Find.

There are general anti-avoidance rules in Malaysia which allow the Malaysian Inland Revenue Board MIRB to disregard vary or make any adjustment deemed fit. D the term tax means Malaysian tax or Indonesian tax as the context requires. Thus in most tax jurisdictions anti-avoidance provisions are included in the tax laws to defeat.

Thus in most tax jurisdictions anti-avoidance provisions are included in the tax laws to defeat. INTRODUCTION Although tax avoidance practices are as old as taxes themselves Andreoni Erard Feinstein. Tax avoidance in Malaysia by Jeyapalan Kasipillai 2010 CCH Asia edition in English.

During colonial rule the British introduced taxation to the. Some examples of tax fraud which may take place in Malaysia are. PDF On Dec 28 2018 Nor Atikah Binti Shafai and others published Earnings Management Tax Avoidance and Corporate Social Responsibility.

2 Tax avoidance PwC Alert Issue 116 October 2014. E the term person includes an individual a company. Government of malaysia and the government of the republic of croatia for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income croatia original.

False reporting of income. Malaysia or Indonesia as the context requires. For example if you want to reduce company tax payable in Malaysia pioneer status firms can.

From the perspective of revenue authorities it is equally important to counter tax avoidance. Although tax avoidance is acceptable in the eyes of law in Malaysia the tax authority taken an extreme change of stance since 2010 and triggered Section 140 of the. Malaysia is a member of the British Commonwealth and its tax system has its roots in the British tax system.

Tax avoidance in Malaysia by Jeyapalan Kasipillai 2010 CCH Asia edition in English. Businesses can take advantage of a variety of tax incentives and tax exemption schemes.

Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account Nri Saving And In Investment Tips Savings And Investment Savings Account

Difference Between Resident And Nri Fixed Deposit India Nri Saving And Investment Tips Savings And Investment Investment Tips Investing

Tax Knowledge For Individuals And Households Toughnickel

Pdf Government Ownership And Corporate Tax Avoidance Empirical Evidence From Malaysia Semantic Scholar

Is It Mandatory To Declare Foreign Bank Accounts And Assets In Income Tax Return By Nri Nri Saving And Inv Income Tax Savings And Investment Investment Tips

Can You Deposit Indian Rupees To Nre Account Savings Investment Tips Savings And Investment Accounting Investment Tips

Tax Revenue As A Percentage Of Gdp In Malaysia And The Oecd Countries Download Scientific Diagram

Estimating International Tax Evasion By Individuals

Estimating International Tax Evasion By Individuals

Pin On Shop One B December 2021

Mrs Brown S Boys To Be Axed Following 2 Million Offshore Tax Avoidance Scheme Our Girl Bbc Our Girl Michelle Keegan

Developing Countries More At Risk Of Lost Corporate Tax Revenues

The State Of Tax Justice 2021 Eutax

Wkisea Treading The Fine Line Between Tax Planning And Tax Avoidance

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

Pdf The Relationship Between Tax Evasion And Gst Rate

Summary Tax Avoidance And Offshore Wealth Policies For Tomorrow Eutax

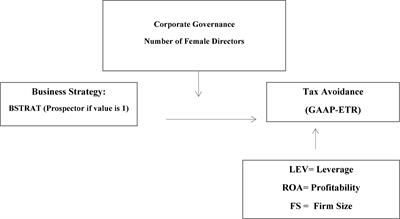

Corporate Business Strategy And Tax Avoidance Culture Moderating Role Of Gender Diversity In An Emerging Economy Frontiers